Selfwealth Most Traded ASX Stocks: May 2022

Rene Anthony

The key headwinds weighing on the market related to heightened concerns about rising interest rates, both home and abroad. Tech stocks tend to be susceptible to valuation concerns when interest rates are rising. Real estate stocks also typically struggle during rate hike cycles as investors anticipate a decrease in property prices and higher borrowing costs.

Beyond the industrials' and materials' sectors, which were the only groups to show some resistance, there were few bright spots in May. Sentiment improved late in the month, paring what would have otherwise been a larger decline across the board.

How did Selfwealth members respond? Here a look at last month trading action.

What are the most popular ASX shares and ETFs?

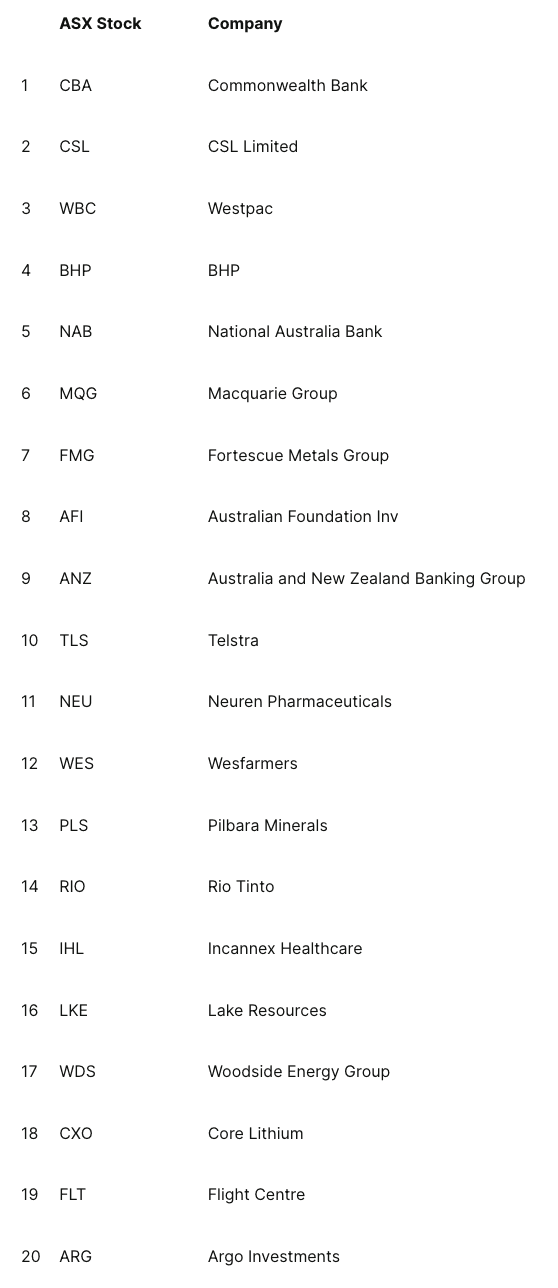

A diverse list of names feature among the most popular stocks in the Selfwealth community, including shares from the following sectors:

Materials (6)

Financials (5)

Healthcare (3)

Consumer Discretionary (2)

Listed Investment Companies (2)

Energy (1)

Telecommunications (1)

The above mix aligns quite similarly with the ASX, where materials and financials represent 55% of the entire S&P/ASX 200 index.

While blue-chip heavyweight stocks such as Commonwealth Bank (ASX: CBA) and BHP (ASX: BHP) remain mainstays, with holdings managing to increase last month despite a broader sell-off, a growing number of emerging names are now featuring more prominently.

Lithium shares Pilbara Minerals (ASX: PLS), Lake Resources (ASX: LKE), and Core Lithium (ASX: CXO) have become the new-age' stocks from the materials sector. A couple years ago the trio were flying under the radar, but now all three are sitting comfortably in the top 20. A sharp decline in these names on the opening day of June will ask questions of investors over these coming weeks.

There are also small-cap health stocks like Neuren Pharmaceuticals (ASX: NEU) and Incannex Healthcare (ASX: IHL) taking up a place alongside biotech giant CSL (ASX: CSL). This suggests Selfwealth members are eying growth opportunities, at an early stage, as well as mature businesses with global reach.

More broadly, the top 20 most popular stocks in the Selfwealth community account for just over $1.7 billion in value. This is fractionally lower than the corresponding result from both March and April, but it also reflects the market downturn over that period.

Turning to ETFs, the leading funds held by Selfwealth members total more than $2.2 billion in value. Despite all being frontrunners, there is still a significant difference in the popularity of these exchange-traded funds, with units in the Vanguard Australian Shares Index ETF (ASX: VAS) outsizing the BetaShares Diversified All Growth ETF (ASX: DHHF) by a factor of tenfold.

ASX share trading activity

With over $80 million worth of shares traded, ANZ (ASX: ANZ) led the way last month as trading activity in the bank more than doubled. ANZ also attracted the most buying interest of any stock, totalling $44.5 million. This was at least $15-20 million ahead of its banking peers. ANZ popularity last month wasn't due to a strong performance either. In fact, the stock underperformed. ANZ shares slumped 8.3% in May, while Commonwealth Bank, Westpac (ASX: WBC), and NAB (ASX: National Australia Bank) traded flat or slightly down.

However, it appears the dip in ANZ share price was the catalyst for investors to swoop in. The company released its half-year results in early May, and it appears the bank outlook is currently the biggest issue dividing ANZ shareholders. The stock tanked in the days following its results. ANZ also hit a hurdle on news that ASIC has commenced a civil proceeding against it with regards to some instances where it charged credit card cash advance fees.

Nasdaq-related ETFs are proving a popular trade at the moment on the back of volatility across global equity markets. Tech stocks have been marked down significantly over the last six or so months, and this has prompted strong buying in funds like the ETFS Ultra Long Nasdaq 100 Hedge Fund (ASX: LNAS) and Betashares Nasdaq 100 ETF (ASX: NDQ).

But not everyone is on board with the idea of a rebound in the Nasdaq. Many Selfwealth members snapped up units in the ETFS Ultra Short Nasdaq 100 Hedge Fund (ASX: SNAS), which rises as the Nasdaq 100 falls. This ETF experienced a record month across the platform in May, with $58 million in SNAS' units traded, and roughly $30 million being buy orders.

Elsewhere, trading in Pilbara Minerals (ASX: PLS) shares was up almost 60% versus the month prior, with a slight majority leaning towards the buy side. Although PLS ranked 11th among the most actively-traded stocks by value, it placed 7th in terms of overall orders filled throughout May.

There were more than 1,200 trades in PLS shares during May, with over 750 of them being buy orders. After taking into consideration other lithium stocks like Lake Resources (ASX: LKE) and Core Lithium (ASX: LKE) - with 1,500 buy orders between the pair - lithium exposure is still a hot theme across the Selfwealth community.

Among the other major movers last month, Fortescue Metals Group (ASX: FMG) had a somewhat uncharacteristically quiet' month, with trading down by over one-third versus April. Some of that interest may have flowed through to BHP (ASX: BHP), where trading activity spiked more than 50% as it divested its petroleum assets.

Wesfarmers (ASX: WES) was another stock that became a talking point after its retail peers in the US reported significant headwinds in terms of inflation. That led to Wesfarmers' shares being hit particularly hard in one trading session, with selling activity edging out the efforts of the bulls last month.

That all for this Trade Trends report, stay tuned for the next edition this time next month!

Important disclaimer: SelfWealth Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.