Most Traded Stocks in FY22

Rene Anthony

The benchmark index shed 10.2% over the last 12 months, with the market finding itself in a holding pattern during the first half of the financial year, before then entering correction territory over recent months. That fall has been sparked by a sell-off in global equities, with investors anxious about runaway inflation, rate hike cycles, and the risk of a recession.

Despite the sell-off, Selfwealth members have stuck by some of their favourite stocks during the recent downturn, even continuing to back some of the market’s underperforming names.

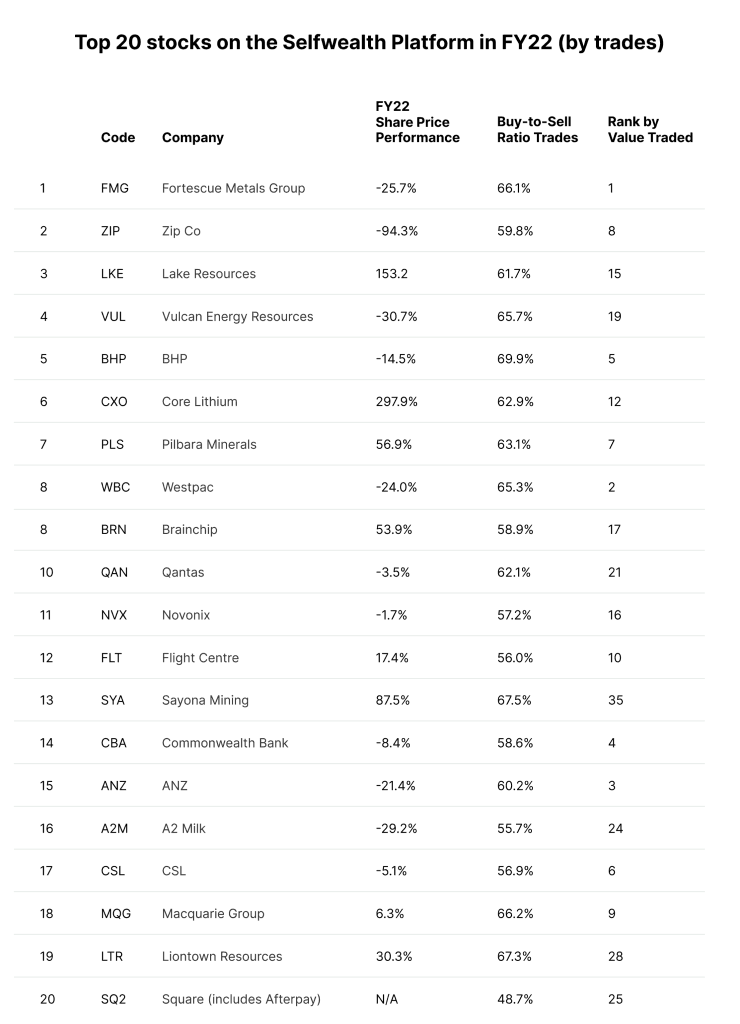

Here are the most traded stocks from FY22.

The Big Picture Across the Selfwealth Community

With more than hundreds of thousands of trades across the top 20 most traded stocks in FY22 on the Selfwealth platform, and nearly 210,000 trades across the top 10 most popular ETFs, investors haven’t let the volatile market dampen their investment goals.

A large part of that willingness is a trend that saw Selfwealth members increasingly turn to ETFs as their preferred investment. In a market where picking individual stocks has proven challenging for many, ETFs have provided a means for investors to easily diversify their portfolios and mitigate their risk exposure.

In FY22, trades in the top 10 most popular ETFs grew 40% over FY21, which offset a 15% decline in trades across the top 20 most traded companies across the community.

However, despite fewer trades in leading ASX companies, members who did invest in these top 20 stocks have done so with greater conviction. The average trade size across this cohort in FY22 was $28,779, rising from $23,155 in FY21, and nearly double the platform-wide average of $15,211.

Of the 220,000 trades in the top 20 stocks on the Selfwealth platform in FY22, some 62% were buy orders. This was slightly less than the average of all securities across the platform, which was 67.8% in H1 FY22, and 64.2% in H2 FY22.

By value, the top 20 stocks accounted for roughly $6.3 billion worth of shares swapping hands, up from $6 billion in FY21, while trades in the top 10 ETFs increased over 30% from $2.2 billion to $2.9 billion.

The Key Takeaway

Other than trading being less concentrated in the hottest stocks on the market, and ETFs gaining traction, there was one key observation in FY22. Unlike the year prior, where stock popularity and share price performance were largely in alignment, FY22 flipped that script on its head.

This is largely due to the market sell-off seen throughout the second-half of the financial year, with some of the most traded stocks in the Selfwealth community bearing the brunt of the impact.

Less than half of the stocks in the top 20 – or eight out of ten – delivered a positive return across FY22. In other instances, returns among some of the out-performers were pared back considerably versus late 2021. The median return among the top 20 cohort was -3.5%, arguably a more indicative barometer than the average (23.4%), which is skewed by two outliers.

And finally, there was only one stock in the top 20 where selling activity outweighed buying interest, a remarkable feat in the context of a market correction, and an indicator that Selfwealth members largely look to the future when buying shares.

The Most Popular Stocks in FY22

Fortescue Metals Group (ASX: FMG) was the most traded stock in FY22, with nearly 20,000 trades, and over $800 million worth of shares swapping hands. The company’s popularity, and that of industry peer BHP (ASX: BHP), have been underpinned by a boom period for commodities. This includes elevated iron ore prices that at one stage circled US$160 per tonne, and some of the largest dividend yields across all ASX-listed large-cap stocks.

Zip (ASX: ZIP) ended the financial year as the second most actively traded stock across the Selfwealth platform, although interest waned significantly in the second half as the buy-now pay-later sector came off the boil.

The total number of trades in ZIP was three times greater in H1 FY22 than H2 FY22, and despite the company’s share price cratering almost 95% across the period, the buy-to-sell ratio in ZIP shares actually increased during the second half.

Square (ASX: SQ2), the parent company of Afterpay, was also testament to subdued interest in payment stocks as the financial year progressed, with trades down over 50% half-over-half.

Elsewhere, shares like Lake Resources (ASX: LKE), Core Lithium (ASX: CXO), Pilbara Minerals (ASX: PLS), Novonix (ASX: NVX), and Liontown Resources (ASX: LTR) rode a wave of positive sentiment in H1 FY22 as interest for battery metals soared. However, each of these stocks suffered a disastrous second half following the rotation out of growth stocks, which dragged their FY22 returns lower.

With a share price that underperformed its peers, Westpac (ASX: WBC) was the most actively traded stock in FY22 from the financials sector. While the bank has felt the effects of competition ramp up and hurt margins, investors bought the dip, banking on a positive impact from rising interest rates.

Not only is Westpac the eighth most traded stock on the platform by number of trades, it is the second most traded stock by value of trades, with nearly $700 million worth of shares in WBC traded.

Other than LKE and CXO, Brainchip (ASX: BRN) was one of the only stocks in the top 20 that saw an increase in trading activity in the second half of the financial year.

Trades in BRN grew more than threefold between the two halves, albeit largely centred on a bright start to the calendar year when Mercedes-Benz announced it would use Brainchip’s neural processing hardware and software in its Vision EQXX concept car. That also marked a high for the stock, and again, while Brainchip’s FY22 return was very strong, the stock is down more than 60% from its all-time high.

In the case of Qantas (ASX: QAN) and Flight Centre (ASX: FLT), trading largely followed ‘bets’ around the recovery in the travel sector.

Travel stocks saw an immediate spike in interest in the first half of the financial year as Australia’s lockdowns ended and international borders opened, but some of this interest has eased more recently as the sector deals with staff shortages and mass flight cancellations.

The Most Popular ETFs in FY22

With stock markets around the world in freefall during 2022, the performances of the most traded ETFs on the Selfwealth platform took a big hit this financial year.

Betashares Asia Technology Tigers ETF (ASX: ASIA) was the worst performer, dragged down by regulatory intervention and lockdowns in China that spooked investors across the Asia region.

The Betashares Nasdaq 100 ETF (ASX: NDQ) also lagged other ETFs, with its exposure to tech-heavy US stocks acting as a headwind.

Nonetheless, Vanguard ETFs have a dominant position in the community, drawing the largest interest at the top of the list, and with four names across the top 10. However, not to be outdone, BetaShares also saw four of its ETFs resonate with Selfwealth members, albeit these funds have a tech focus.

Despite a large variance between products, the data once again points to long-term wealth creation goals across the Selfwealth community, with each ETF overwhelmingly being bought as opposed to sold.

As a final note that highlights the growing popularity of ETFs, the total number of trades in the top 10 exchange-traded funds was broadly equal to the number of trades in the top 20 stocks listed above, which emphasises the cornerstone nature that ETFs serve in many Selfwealth members’ portfolios.

Important disclaimer: SelfWealth Ltd ABN 52 154 324 428 (“Selfwealth”) (AFSL 421789). The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser and/or accountant. Taxation, legal and other matters referred to on this website are of a general nature only and should not be relied upon in place of appropriate professional advice. You should obtain the relevant Product Disclosure Statement for any product mentioned and consider its contents before making any decision.